News

Jumia reduces losses by over 90% in Q4 amid focus on restoring order and GMV growth (TechCrunch)

February 15, 2024Company News

In 2023, Jumia revised its adjusted EBITDA loss guidance thrice: $100 million to $120 million in Q1; $90 million to $100 million in Q2; and $80 million to $90 million in Q3, aiming for a 57% to 61% year-over-year reduction if met.

The company exceeded these expectations and significantly outperformed in that regard. It ended the year with $58.2 million in adjusted EBITDA loss, marking a 68% decrease from 2022, and Q4 concluded with less than $1 million in adjusted losses, a 99% decrease. Jumia’s operating loss decreased by 90% to $4 million that quarter and by 64% to $73 million for the entire year, leading to an improved liquidity position, closing the year with $121 million according to its Q4 2023 and full-year financials.

These losses were reduced primarily by decreased tax provisions in specific countries, a nonrecurring event that occurred in the last quarter of 2023. Also, significant decreases in sales and advertising expenses, down 63% year-over-year, and general and administrative expenses, down 54% year-over-year, contributed. For the latter, Jumia’s notable exit from the food delivery business in Q4 led to layoffs and departmental restructuring, resulting in a 17% decrease in staff costs within G&A expenses year-over-year.

“We’ll continue looking for more efficiencies whether on a daily, monthly, or weekly basis. We keep on finding new opportunities to be a bit leaner and to spend a bit less money not only on staff but also on tools, logistics, and so on. In some countries, we’ve identified that we could be a bit leaner in some departments. It’s an ongoing optimization and we’re running adjustments, so it’s business as usual for us,” Jumia CEO Francis Dufay said on a call with TechCrunch.

In addition to macroeconomic conditions such as currency devaluations impacting consumers’ purchasing power, Jumia’s strategic decisions, including exiting the food delivery sector and reducing customer incentives, contributed to a 4% decrease in orders to 6.6 million, a 16% reduction in active customers to 2.3 million, and an 8% decline in GMV (gross merchandise value) year-over-year to $233 million.

Nevertheless, the company remains optimistic that its focus on physical goods, such as electronics and fashion items, will drive improvements in these metrics while keeping losses minimal. A slight indicator is the increase in quarterly active customers, orders, and GMV by 16%, 17%, and 42%, respectively, quarter-over-quarter, primarily fueled by successful Black Friday and Christmas sales campaigns. There’s also the rise in the average order value for physical goods, climbing from $40.6 in 2022 to $45.5 in 2023, which likely cushioned the impact on the company’s Q4 and full year revenue experiencing a modest 2% and 8% year-over-year decline to $59.4 million and $186 million.

“In 2024, we expect to improve our economics further and reduce cash utilization better than in 2023 and get back to growth on the orders and GMV excluding foreign exchange impact,” said Dufay. “We will maintain the same strategy on the marketing side so that we will be very prudent and conservative on all expenditures and the whole cost base, and with that, we believe that we have everything it takes to grow profitably.”

Investors have shown approval for Jumia’s cost-cutting measures throughout the year, with its share price rallying up 40% at the time of publication.

Meanwhile, JumiaPay’s Total Payment Volume (TPV) stood at $59.3 million in Q4 2023, marking a 10% decrease year-over-year. However, transactions surged, reaching 3 million, a 41% increase year-over-year; 45% of orders on the Jumia platform in Q4 2023 were completed using JumiaPay, up from 31% in Q4 2022.

Read the original article on TechCrunch

About Jumia

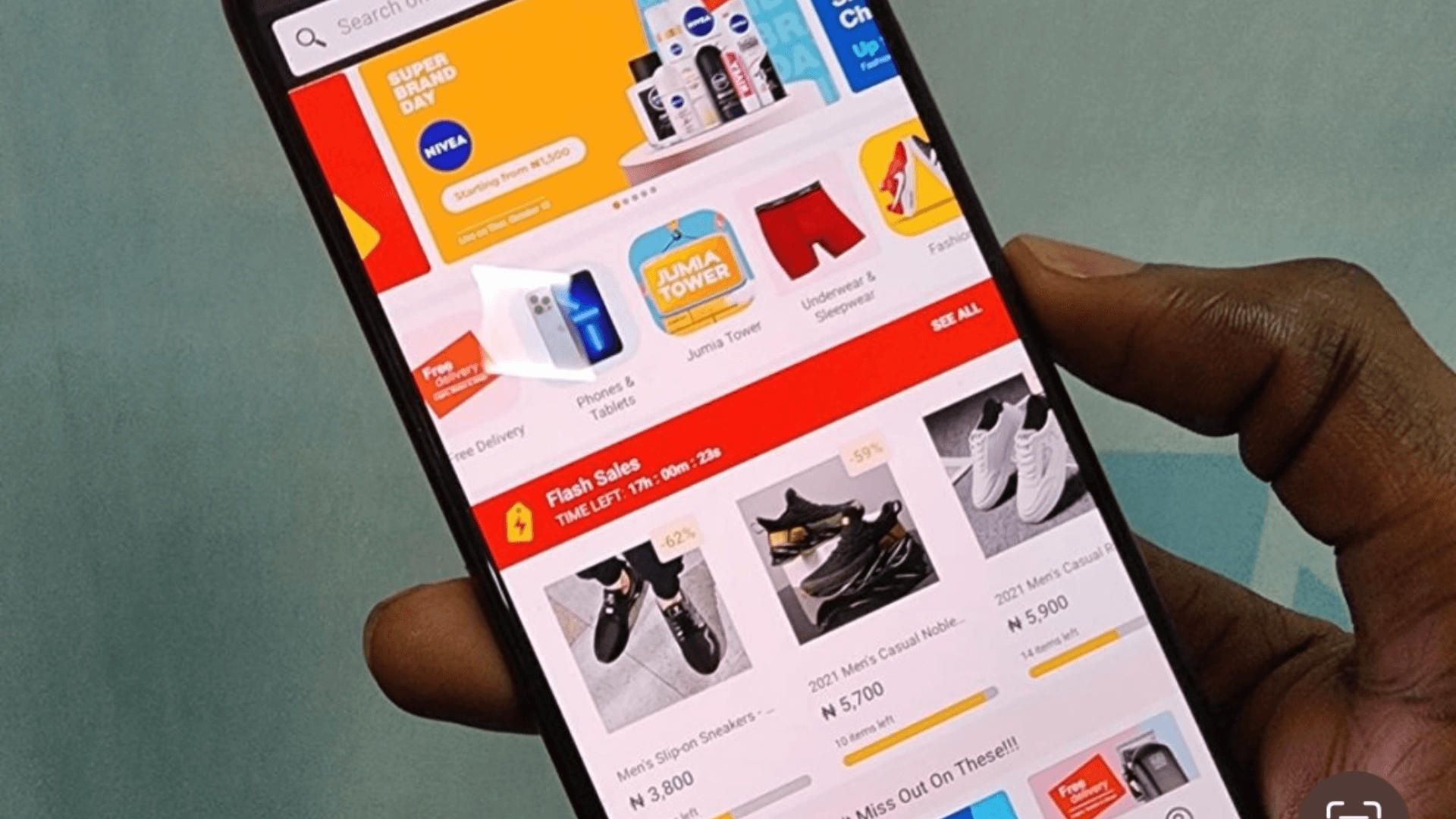

Jumia is a leading e-commerce platform in Africa. Our marketplace is supported by our proprietary logistics business, Jumia Logistics, and our digital payment and fintech platform, JumiaPay. Jumia Logistics enables the seamless delivery of millions of packages while JumiaPay facilitates online payments and the distribution of a broad range of digital and financial services.

Follow us on, Linkedin Jumia Group and X @Jumia_Group

For more information about Jumia:

Abdesslam Benzitouni

[email protected]