News

Jumia's Business Prospects: Personal Reflections And A Candid Conversation With The CEO (Seeking Alpha)

February 26, 2025Company News

Summary

- Jumia Technologies has restructured for efficiency and growth, showing resilience in the African e-commerce market despite market skepticism and current low stock prices.

- CEO Francis Dufay highlights Jumia's strategic focus on customer experience, market efficiency, and logistics, leading to significant growth in orders and customer base.

- Jumia's competitive advantages include a robust distribution network and the ability to offer cash on delivery, positioning it well against competitors like Temu.

- Despite financial challenges, Jumia is on a path to profitability, with strong execution and improved financial guidance for 2025.

There is perhaps nothing harder in investing than believing in a business and economic story that the market does not or cannot appreciate. I find myself at such a juncture with Jumia Technologies (NYSE:JMIA). For two years, the company has worked diligently to restructure itself for efficiency, value, and to position for expansion into the future opportunity of e-commerce in Africa. With this work now bearing the fruit of definitive year-long guidance and the outlines of a path to profitability, the stock has seen fit to price in failure. Where the market sees struggle, I see the profile of a company made resilient and robust for the rigors of African marketplaces. While the stock market stews over its angst on JMIA, I continue to tell the story in the expectation of better performance in the future.

This latest piece on JMIA covers four components: insights from my latest interview with CEO Francis Dufay including results from earnings and the accompanying conference call, my observations from visiting Jumia's warehouse in Lagos, a "man on the street" discussion about the benefits of shopping with Jumia in Lagos, Nigeria, and a qualitative assessment of the macroeconomic environment in Nigeria. My goal is to paint a comprehensive and clear picture about Jumia's opportunity amid all the on-going challenges.

The Interview

The Market Is Always Right, However

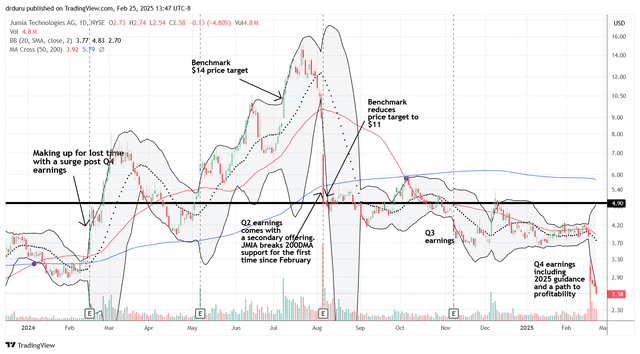

I went into this interview with Dufay knowing that the market had responded to the earnings news with a 20% or so pre-market sell-off. (At the current 15-month low, the market has reversed all the gains from the excitement driven by JMIA's steady progress against all its strategic goals). So during the interview I asked Dufay the question that should be top of mind for any long-term investor absorbing the current losses: the stock price is incredibly low given the long-term potential for Jumia, how do you describe what the market is missing?

JMIA has experienced a whirlwind of price action (tradingview.com)

JMIA has experienced a whirlwind of price action (tradingview.com)Dufay started his answer by acknowledging that "the market is always right." However, he reiterated "the big news" - Jumia is back to growth by benefiting from a clear strategy focused on up-country, value formation, better customer experience, and market efficiency. He underlined the effort involved by explaining this is "healthy stuff and hard work." For the first time in a long time with very low marketing cost, Jumia is expanding the customer base by 8% and growing physical orders by 18% (year-over-year for Q4). In other words, the "health KPIs are turning green, really green."

The growth rate is going up every quarter for orders and customers. The fundamentals of the core B2C (business-to-consumer) business are improving. Jumia has delivered significant transformation in the second half of 2024 including: "completely restructuring the logistics network…and very smoothly executing the exit of two markets." The latter effort was necessary to refocus the company on its markets with profitable potential.

Just in time for this important milestone, the year-over-year comparisons for financials have complicated assessment of the business. Dufay explained complications from "the lagging effect of devaluations [that Jumia is now lapping] and a decrease in corporate sales [mainly in Egypt] which impacted GMV (gross merchandise value), revenue, and gross profit down to the EBITDA [line] that were netted out at the net loss level." Thus, year-over-year comparisons look bad and confusing for anyone solely focused on revenue and EBITDA. (More below on how to interpret these dynamics).

Dufay also acknowledged that cash is "not exactly where we want it to be." However, Dufay expects the impact from working capital to moderate in coming quarters. Cash flow also took a hit from office closings and some deferred payments from the offering in August. Thus, "that financial picture can explain some of the market sentiment today."

The future looks different. Dufay confidently pointed out that "based on the fundamental improvements and strong execution…and what we see in Q4 and early Q1, we were able for the first time to guide with more precise numbers on orders growth and GMV growth and the reduction of losses."

Complicated Year-Over-Year Comparison

Dufay took some time to walk through the factors complicating the year-over-year comparison. Q4 2023 had strong profit margins driven by corporate sales, mostly in Egypt. These margins were "wiped away by significant finance costs for repatriating the cash", an effect that shows up below the EBITDA line. Finance costs come between the EBITDA and the loss before income tax. Jumia incurred a high cost of repatriating cash from Egypt because of a large spread between the official and parallel exchange rates. Thus, the financial comparison is very difficult this year. (Also note that these dynamics mean that a recovery in Egyptian corporate sales could generate yet more complications in year-over-year comparisons). Dufay recognized that "people will ask why were you close to break-even last year on EBITDA and this year very far from it now?" His answer is "because Jumia had a loss before the income tax level where you see the full picture including the cost of repatriation."

As a result, Dufay explained that "the fair comparison is loss before income tax." This metric is around the same level as last year. Jumia's CFO Antoine Maillet-Mezeray explained the company's loss before income tax in more detail during the conference call by first reiterating that "loss before income tax from continuing operations captures items that are not included in adjusted EBITDA." He went on to explain that "loss before income tax from continuing operations, should be considered in order to gain a fuller view of Jumia's financial state, capturing both operational efficiencies and the impact of the financial results, which we believe, are important to understand the company's overall progress towards sustainable profitability." For Q4, income before income tax includes the changes in the cost of repatriating cash. Loss before income tax from continuing operations for Q4 increased just 3% (down 19% on a constant currency basis) and declined 1% year-over-year (down 8% on a constant currency basis).

Competition

During the earnings conference call, Dufay made a rare reference to the competition: "Our extensive 3PL (third-party logistics) network represents a competitive moat over other e-commerce players lacking the necessary infrastructure for delivery beyond major cities." Given this reference to the competition, I asked whether Temu, an e-commerce seller of cheap Chinese goods, and its expansion into the Nigerian market drove this commentary. Temu's expansion serves as further validation of the potential of the Nigerian market, but the move could also cap Jumia's opportunity.

Dufay reassured that while "they are really good at value for money", there is "plenty of room for growth for [Jumia], Temu, and other players if any." Having said that, Dufay was quick to point out that "we have competitive advantages" with an efficient, low-cost distribution network across Nigeria that is working with full economies of scale. Temu has not yet set up such a network. Moreover, Jumia's pick-up stations (PUS) are a critical asset more valuable than door delivery. The economics are poor for providing free door delivery from Lagos to nearby towns. Jumia has also found its PUS to be extremely helpful for customer interaction and marketing the brand (as demonstrated by my man-on-the-street vignette below). Dufay called Jumia's distribution network "a competitive moat."

Moreover, Jumia can do cash on delivery, and the company already has significant supply sources from international vendors in China, Egypt, and Turkey. Jumia announced in Q4 earnings that it had "3.4M gross items sourced from international sellers, mostly from China, accounting for 31% of gross items, up 61% year-over-year." Thus, Jumia is able to compete on affordable items in a market with plentiful supply from China.

A Path to Profitability

In the Q4 earnings report, Dufay declared "I am confident that we are well-positioned to deliver sustainable growth and achieve profitability." During the earnings conference call, Dufay claimed that "we have a clear line of sight to achieve profitability." This was the first earnings call with Dufay that made explicit reference to a path to profitability. I took note because a convincing path to profitability could deliver the next key turning point for the Jumia story. In our discussion, Dufay explained his optimism: there are more stable trends in the business, in costs, and in foreign exchange. The macroeconomic environment is also less uncertain. Accordingly, Jumia has "much better control on the top line and the bottom line" according to Dufay. This confidence and optimism drove the concrete, full-year guidance. From the earnings report:

- Physical goods orders growth: 15% to 20% year-over-year.

- GMV growth: 10% to 15% year-over-year (representing $795M to $830M), excluding foreign exchange impacts.

- Loss before income tax decline: 33% to 28% (representing -$65M to -$70M).

This guidance compares favorably to 2024's results. From the earnings presentation:

- Quarterly physical goods orders growth: 0%, 7%, 7%, and 15% (excluding Tunisia and South Africa for Q4) year-over-year for Q1 to Q4 respectively.

- GMV growth: -4% (+28% in constant currency)

- Loss before income tax from continuing operations: relatively flat year-over-year (down 8% in constant currency).

Jumia's CFO estimated the company needs to double or triple orders volume to get to profitability. During the interview, Dufay further clarified that they cannot yet get more specific on that estimate. However, he walked through the simplest scenario for profitability using the current fixed cost base. For 2024, gross profit after fulfillment (or variable cost) was $57M. The EBITDA loss was $51M. So, a back of the envelope calculation suggests that doubling the volumes also doubles the gross profit (after fulfillment) and thus covers the EBITDA loss. I assume that a tripling in volumes would provide a buffer against volatility in other profit drivers. Continued success driving down the cost side - SG&A and fulfillment - can shorten the path to profitability.

An Exemplary Warehouse in Lagos

Earlier this month, I traveled to Nigeria to visit family and friends. During my stay in Lagos, Jumia generously offered me the opportunity to visit the company's warehouse in Africa's most populous city. Given Lagos's legendary traffic issues, I made sure to stay in a nearby hotel the night before. For extra buffer, I asked my driver to pick me up early. Fortunately, we had no issues. After passing security checks, I was welcomed by the head of Public Relations, Corporate Affairs, and Communications first into an office area where a large group of young workers were stationed around a rectangular configured work area. These employees represented warehousing, logistics, finance and human resources. With laptops at the ready, they looked like the central nervous system of the operations.

The CEO of Jumia Nigeria, Sunil Natraj, soon joined us along with the head of Supply Chain. Together with the head of Security, we started our tour of the warehouse.

During our conversation, Sunil explained how Jumia promotes economic development. He is of course bullish on Nigeria and its potential. He moved from Ghana to take on work in Lagos with Jumia. Sunil described Nigeria's dynamism and its resilience. The push to "make it every day" means there is a drive to innovate.

This drive also translates into the company's obsession with efficiency. Every day, every moment, Sunil, the CEO of Jumia, and team are optimizing. For example, during my tour, Sunil noticed a lone box sitting on a rack and discussed this box with the head of Supply. Sunil explained that he saw extra cost in this box (I was not privy to the conversation).

I was first taken aback by the enormity of the warehouse space. We weaved our way through rows and rows of goods, some assembled in Nigeria: gas ranges, refrigerators, freezer chests, fans (extremely popular), solar fans, washers, fashion goods, fast-moving household goods, food items like rice, and even alcohol. Jumia is a popular source of alcohol, given the trust people have in the product and delivery. Heightened security did not allow me to step inside the area for high-value goods like cell phones and laptops. Like everywhere else, the large space was primed to deliver on eager demand. Sunil explained how product availability is its own marketing. Even when a customer does not buy during a given shopping session, Jumia becomes top of mind for the next product search.

Everywhere we walked included employees fulfilling orders and staging inventory. When an order arrives, the task, of course, is to get the goods to the customer as fast and efficiently as possible. Products are retrieved from staging areas and placed in bins according to labeled shipping routes. Small goods get wrapped individually. Large goods stay in their original packaging. All goods are sent by truck using third-party logistics, with each truck filled as close to capacity as possible. Jumia is focused on perfecting its core competency of sourcing supply and filling demand.

My warehouse visit gave me a renewed appreciation for what Jumia is trying to accomplish in Nigeria and its other African markets. The entire operation looks well-organized and well-run. I even had the opportunity to see part of a training program where attentive new employees were getting debriefed on company policies. Overall, the visit was a great complement to my long-standing interest and support of the company.

Me (pictured third from the left) with the good folks at Jumia, Lagos, Nigeria. (Jumia Technologies)

Me (pictured third from the left) with the good folks at Jumia, Lagos, Nigeria. (Jumia Technologies)One Customer's Perspective

Jumia's YouTube channel is full of testimonials of customers and employees. I talked directly to a customer when I asked my driver whether he had ever ordered anything from Jumia. He perked up excitedly and told me the story about a washer he ordered from Jumia. He described a simple and orderly process: go online, place order, receive a tracking number, pick up order after receiving notification that the product is available. In his case, the PUS is very close to his home and thus exceptionally convenient. My driver sang Jumia's praises because of the company's reliability and reputation.

My driver contrasted Jumia with the shaky experience of ordering from the many online vendors cropping up. These shops offer goods for sale but become unresponsive after customers pay for orders. Thus, Jumia brings trusted commerce to the online experience in a country like Nigeria, fraught with online perils. In previous earnings conference calls, Dufay spoke about the work the company does to engender trust. That effort is clearly paying off.

My driver is a just one more story, but his is a powerful one that validates Jumia's potential to transform the consumer e-shopping experience in Africa.

"Qualitative" Macroeconomics

"Everybody wants to leave Nigeria…because you work every day of your life, and you don't see the money you're working for!" This is a quote from a 26-year-old woman interviewed in a recent timely piece from the Economist titled "Africa's young 'generation hustle' hits the big time - They are pious, entrepreneurial and eager to make the most of their potential". This same article quotes an African Youth Survey that claims 37% of young Africans want to leave their home countries and migrate to America. My casual conversations during my trip in Nigeria were consistent with this sentiment, a sentiment which of course augurs poorly for prospects in the related African countries. The sentiment also speaks volumes about the urgency of economic development and supporting healthy marketplaces.

My latest trip to Nigeria was a directed effort to focus on and look for the positives of life in the country. The hustle culture in Nigeria, and in so many African countries, is like a pulsing economic force straining to be unleashed. So many people hustle every day just to survive. That same work ethic powers the success of those who are fortunate enough to gain access to opportunities. As one of my drivers explained to me, Nigeria has so much promise with the right kind of change. I cling to that same hope and expectation that Jumia is part of that change.

Traveling through Nigeria, you can see on most every roadside the bustling hum of economic activity. A good amount of it is what I call subsistence commerce, where sellers of the same assortment of low margin goods proliferate in the expectations of making just enough money for basic essentials for the short-term, maybe even just the day. In a major city like Lagos, you can also find shopping malls packed with shoppers in the middle of the week. The airports are busy and crowded with domestic travelers. Money is flowing in the Nigerian economy thanks to point-of-sale (POS) stations, where vendors use mobile devices to process bank cards in exchange for hard cash… for a small fee. They act like human ATMs. In parallel, digital transactions are easier than ever, and it is common to transfer payments directly to a business's bank account with proof of receipt in the form of the issuing bank's confirmation notice.

Thus, Nigeria can be a country of enigmas, where success and struggle live close together. Depending on where you look, you can get excited one moment and jaded the next. Through it all, I am staying the course.

Conclusion

I provided a more detailed view on Nigeria to create a more complete context on why I invest and believe in JMIA. I have a strong buy posture, but the stock rating system is not well-suited for this kind of stock. JMIA is a high risk investment with a high potential for a binary outcome. A stock like this does not fit well with the buy/sell/hold segmentation for ratings. For lack of a better translation, I convert "take it" to a "strong buy", especially given what I see as a steep discount on shares trading at just over 1.0 EV/sales trailing twelve months (TTM) and forward.

A stock like JMIA can attract two types of people on opposite ends of the investment spectrum. On one hand, are the short-term traders with hot hands who are looking for bursts of momentum in either direction. On the other hand, are the persistent optimists, like myself, who look through all the bumps and volatility to what they assume is a large payoff when the drivers and catalysts finally converge for a breakthrough and the financial reporting is straightforward and easy to appreciate. We persistent optimists had a brief moment of validation last year. I look forward to the next phase of validation along the path to profitability.

Be careful out there!

Read the original article on Seeking Alpha

About Jumia

Jumia is a leading e-commerce platform in Africa. Our marketplace is supported by our proprietary logistics business, Jumia Logistics, and our digital payment and fintech platform, JumiaPay. Jumia Logistics enables the seamless delivery of millions of packages while JumiaPay facilitates online payments and the distribution of a broad range of digital and financial services.

Follow us on, Linkedin Jumia Group and X @Jumia_Group

For more information about Jumia:

Abdesslam Benzitouni

[email protected]