News

Nigeria: an analysis of payments and ecommerce trends

November 4, 2025Company NewsNigeria

As Nigeria continues its trajectory toward becoming a USD 1 trillion economy, the payments and ecommerce sectors stand out as key drivers of this transformation. In 2025, following ongoing digital adoption and regulatory evolution, these industries reshaped consumer behaviour, business models, and cross-border trade. Drawing from recent developments, Nigeria's success hinges on leveraging local ingenuity to address persistent challenges, such as infrastructure gaps and financial inclusion.

Payments landscape and trends in Nigeria

Nigeria's payments ecosystem in 2025 is characterised by a rapid shift toward digital dominance, with electronic payments reaching record levels. E-payment transactions have hit NGN 284.9 trillion (approximately USD 196 billion) in Q1 2025, marking a milestone in the country's cashless economy push. This growth is driven by a 20% annual increase in digital transactions across Africa, though cash remains prevalent in informal sectors. Key trends include the rise of digital lending, BNPL, and agent banking, which are becoming the norm for everyday transactions, offering access to financial services for both rural and urban communities. Additionally, interoperability between payment systems is gaining traction, enabling seamless transfers across platforms and reducing user friction.

However, challenges persist: network glitches and fraud concerns continue to hinder full adoption, particularly in rural areas where internet penetration remains low. Looking ahead, the landscape's future lies in bridging this urban-rural divide through investments in real-time digital infrastructure, as outlined in the Central Bank of Nigeria's (CBN) Payments System Vision 2025, which aims to expand electronic payment adoption by strengthening mobile and instant payment channels.

Innovation in Nigeria’s paytech sector

Innovation in Nigeria's paytech space is thriving, fuelled by fintech startups integrating AI, biometrics, and blockchain to enhance security and efficiency. In 2025, generative AI (GenAI) helps optimise fraud detection, while embedded finance allows non-banks to offer payment services seamlessly. Notable advancements include real-time payment rails and tokenized deposits, which are streamlining transactions and reducing costs. The launch of PAPSSCARD, Africa's first pan-African card scheme, shows how innovations are extending beyond borders to facilitate continent-wide payments.

From my perspective, these innovations are not mere technological upgrades but essential tools for financial inclusion. For instance, mobile money operations have seen explosive growth, with AI-powered security systems helping mitigate risks in high-volume environments. Yet, the sector must prioritise ethical AI use to avoid biases in credit scoring. As fintechs like OPay and Moniepoint lead in verticals such as payments and personal banking, the emphasis should be on collaborative ecosystems that integrate with traditional banks, ensuring sustainable innovation amid regulatory scrutiny.

Main players in Nigeria’s payments ecosystem

The Nigerian payments ecosystem is dominated by a mix of fintech unicorns, traditional banks, and payment service providers (PSPs). Key players include:

- Moniepoint: leads in merchant solutions and agency banking, and it was recognised among Africa's fastest-growing firms in 2025.

- PalmPay: provides user-friendly mobile payments, also focusing on growth and regional expansion.

- Paga: specialises in accessible transfers and bills, being a staple for informal economies.

- Flutterwave: excels in processing and integrations, pursuing product diversification.

- OPay: dominates the e-wallets and banking space, having a big impact on personal finance.

- eTranzact and Interswitch: legacy processors handling high-volume transactions.

- Nomba and Zone: innovate in niche areas like POS and decentralised networks.

In this arena, differentiation is key, as seen in the competitive market where players like Paystack excel in seamless integrations for businesses. Overall, the ecosystem's strength lies in collaboration: banks partnering with fintechs under CBN guidelines to enhance infrastructure. With over 40 payments companies active, the focus should shift toward consolidation to avoid fragmentation and foster innovation at scale.

Popular payment methods and solution providers in Nigeria

Popular payment methods in Nigeria encompass a blend of digital and traditional options, with mobile money, bank transfers, and cards leading the way.

- Bank transfers (NIP): preferred for large values, facilitated by NIBSS for instant settlements.

- Mobile money and USSD: dominant in informal sectors, offering accessibility without internet.

- Cards (Visa, Mastercard, Verve): widely used for online and POS, with contactless features.

- E-wallets: account for 7% of digital payments, led by providers like OPay and PalmPay.

- QR codes and Apple Pay: emerging for quick, secure transactions.

Key providers include:

- Flutterwave: supports cards, PayPal, and global options.

- Paystack: handles cards, transfers, and USSD seamlessly.

- Remita: reliable for institutional and government payments.

- Interswitch: offers comprehensive local and international solutions.

In my opinion, the diversity of methods reflects Nigeria's hybrid economy, but providers must enhance user education to boost adoption of secure, contactless options and further reduce reliance on cash.

Nigeria’s ecommerce and marketplaces space

Nigeria's ecommerce market is booming, being valued at USD 9.35 billion in 2025 and projected to grow at 12.46% annually through 2030. Shopping behaviour is increasingly mobile-driven, with over 141 million mobile internet subscribers in 2025, favouring categories like electronics, fashion, and groceries. Consumers prioritise convenience, and with mindful shopping practices rising, they seek value and personalised experiences.

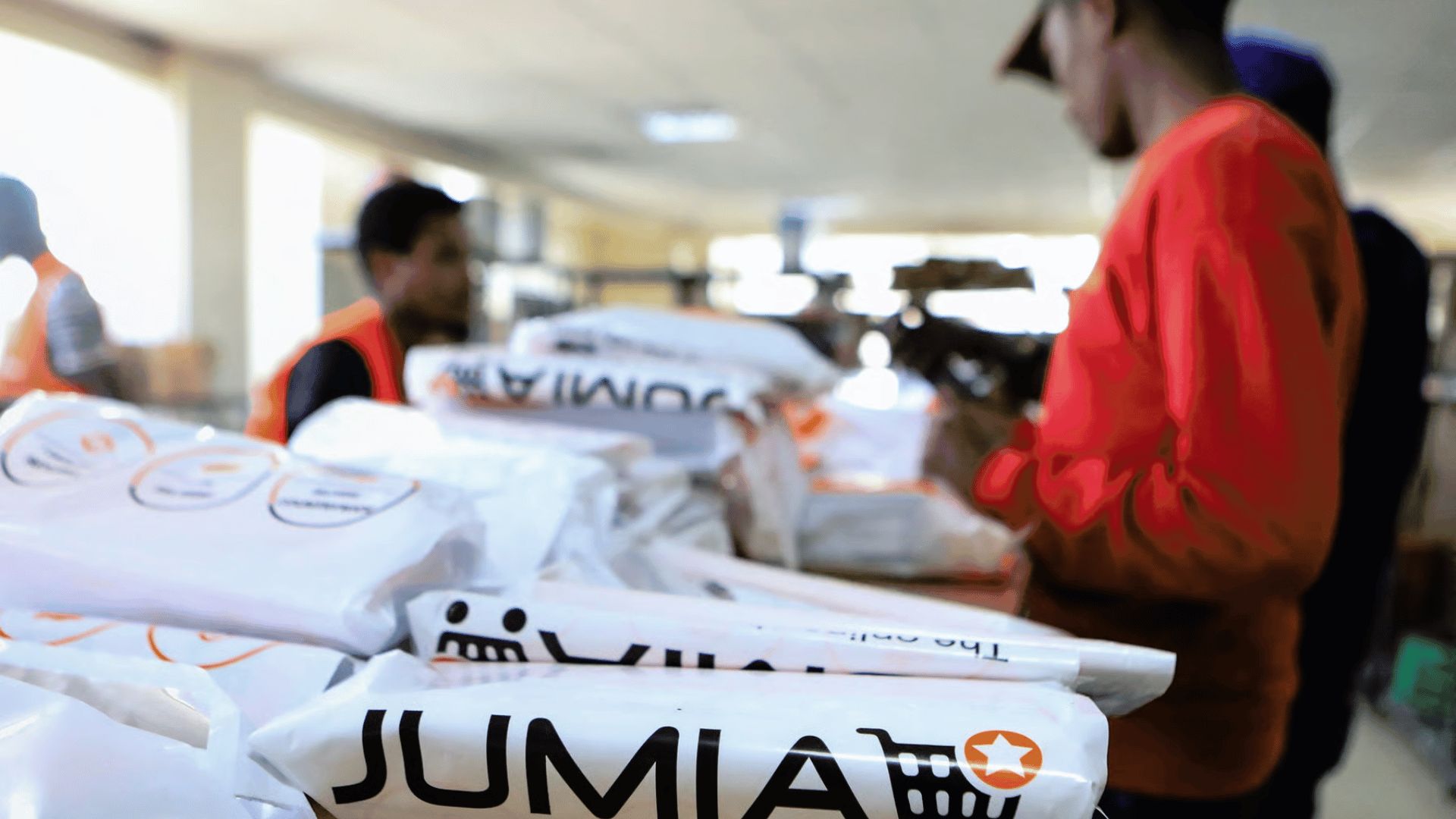

Return policies vary but emphasise customer trust: platforms like Jumia offer a 7-day return policy for most items, with clear guidelines to build confidence. The main players in the ecommerce sector include Jumia, which leads with 25% year-over-year order growth in Q2 2025, other local players like Konga and Jiji, and non-resident platforms like Temu. Hyperlocal marketing and tailored logistics solutions, led by Jumia, are driving adoption and expansion into underserved communities. As internet access continues to improve, ecommerce is expected to democratise retail, especially in rural areas.

Cross-border-related developments in Nigeria

Cross-border payments in Nigeria are evolving rapidly, with the adoption of the Pan-African Payment and Settlement System (PAPSS) simplifying intra-African transactions across 17 countries. According to a new report by Oui Capital, Africa's market is set to triple to USD 1 trillion by 2035, with Nigeria benefiting from faster processing and AI-enhanced security. Key developments include Mastercard's partnerships for scalable payments and CBN's deadlines for compliance by October 2025.

Providers like LemFi and Flutterwave are streamlining remittances and B2B transfers, reducing costs for SMEs. In my opinion, these advancements are crucial for Nigeria's global integration, but aligning regulations across jurisdictions will be key to accelerating innovation and attracting foreign investment.

Regulatory initiatives impacting the payments and ecommerce space in Nigeria

Regulatory initiatives in 2025 focus on fostering trust and innovation while curbing risks. The CBN's ARIP framework and updated fintech rules aim to enhance digital payments accessibility for SMEs, and the federal government's National Digital Trustmark targets fraud in the USD 13 billion ecommerce market, promoting transparency. Therefore, current efforts to eliminate glitches in digital payments underscore a push for quality financial services.

Fintech laws emphasise regulatory bodies like the CBN and SEC, with guidelines on cross-border business and measures to prevent money laundering. I advocate for adaptive regulations that balance oversight with flexibility, as rigid policies could stifle the sector's dynamism. The Payments System Vision 2025 remains a cornerstone, guiding progress toward a robust, inclusive ecosystem.

Conclusion

In conclusion, in 2025, Nigeria's payments and ecommerce sectors represent a vibrant frontier of opportunity, blending innovation with regulatory prudence. By prioritising inclusion and collaboration, stakeholders can unlock the full potential of this digital transformation, positioning Nigeria as a key player in Africa's fintech narrative.

About the author

Temidayo Ojo is the Chief Executive Officer of Jumia Nigeria. He is an adept leader with over a decade of experience spanning project management, commercial sales, and business strategy. He joined Jumia in 2020 as the Head of Planning and Performance, before moving on to become the Chief Commercial Officer in Ghana. Following this, he was appointed CEO of Jumia Ghana. Over the years, he has honed his expertise in crafting and executing transformative strategies within the ecommerce, retail, and consumer goods sectors. Temidayo holds an MBA in Finance, Strategy & Consulting from IESE Business School and a bachelor's degree in Electrical and Electronics Engineering from the University of Lagos.

About Jumia

Jumia is a leading e-commerce platform in Africa. Our marketplace is supported by our proprietary logistics business, Jumia Logistics, and our digital payment and fintech platform, JumiaPay. Jumia Logistics enables the seamless delivery of millions of packages while JumiaPay facilitates online payments and the distribution of a broad range of digital and financial services.

Follow us on, Linkedin Jumia Group and X @Jumia_Group

For more information about Jumia:

Abdesslam Benzitouni

[email protected]