News

Promise and Perils: Scaling up businesses in sub-Saharan Africa

November 15, 2019Research

(The Economist): Africa’s growth recovery offers hope the continent can return to its GDP surge in the earlier part of the millennium—but only if its businesses can scale within and across borders. Policy improvements, including trade and customs unions, financial harmonization, and transport integration, are helping companies build regional footprints.

About this research

Promise and perils: Scaling up businesses in sub-Saharan Africa is an Economist Intelligence Unit report, sponsored by the Dubai Chamber of Commerce and Industry. The report examines the factors enabling businesses in sub-Saharan Africa (SSA) to scale up. We consider the policy environment, state of technology and infrastructure, and financing options that allow businesses to access markets in other countries on the continent and beyond. In addition, it explores the role of foreign investors in facilitating business expansion, focusing on those based in the Gulf Co-operation Council (GCC) countries.

This report combines extensive desk research, data analysis and insights from interviews. We conducted in-depth interviews with executives at businesses in SSA across fin-tech, energy, hospitality and consumer goods that have successfully expanded across countries. In addition, we interviewed investors in Africa and the GCC. The interviews were conducted in April and May 2019.

Our sincerest thanks go to the following participants (listed alphabetically) for their time and insights:

- Alexandre Allegue, chairman, Pawame

- Michelle Essomé, CEO, African Private Equity and Venture Capital Association

- Guy Hutchinson, acting CEO, Rotana

- Wesley Lynch, CEO, and founder, Snapplify

- Magellan Makhlouf, co-founder and managing director, CedarBridge

- Pat McMichael, CEO, Eat’n’Go

- Paloma Pineda, co-founder, Ethical Apparel Africa

- Sacha Poignonnec, co-founder and co-CEO, Jumia

- Keren Pybus, co-founder, Ethical Apparel Africa

- Emmanuel Quartey, head of growth, Paystack

- Tejas Shah, regional vice-president, development, sub-Saharan Africa, Hyatt

- Ashish Thakkar, CEO, Mara Phones

- Hani Weiss, CEO, Majid Al Futtaim Retail

Adam Green is the author of the report and Melanie Noronha is the editor.

Executive summary

The rise and fall of interest in Africa has been contingent on its promise for growth. The demographic advantage and increasing per-head income spur investors but the regulatory complexities and political risks they encounter turn sentiment. Businesses on the continent are innovative and eager to expand but this is often impeded by limited access to new markets and growth finance. Delivering on the promise of economic growth is closely tied to the ability of home-grown businesses to scale up, so policymakers must establish an environment that enables businesses to thrive.

In this report, we explore a range of policies, technologies, infrastructure projects and financing options that are enabling business in SSA to scale up. Some of these are the efforts of local governments and regional organizations but there is also significant involvement from foreign investors and businesses. This report specifically explores the perspectives of investors based in the GCC.

Key findings of this report:

Policies for regional integration are helping African businesses gain greater access to other markets. Some regional economic communities, such as the East Africa Economic Community, are allowing the free movement of people and goods, facilitating trade. The Single African Air Transport Market is expected to strengthen air links, driving tourism and business travel. Among the most ambitious is the African Continental Free Trade Agreement, committed to removing tariffs on 90% of goods, progressively liberalizing trade in services, and addressing non-tariff barriers. Some policies are also easing operational challenges; the most noteworthy are those enabling international money transfers and payments. Combined, these allow African small and medium-sized enterprises (SMEs) to expand operations across markets, creating attractive opportunities for investors too.

Expanding telecommunications networks are facilitating the growth of internet connectivity, mobile money and new digital services that build on it. Mobile money, which facilitates money transfers and payments, is also a growth enabler as it moves into business lending. Wider and better internet connectivity will drive the next wave of technological innovation, enabling companies to develop new, digital services for consumers on the continent. By 2025 3G mobile network coverage is expected to account for 61% of the mobile phone connections.

Foreign companies with expertise in infrastructure development and emerging technologies are capitalizing on Africa’s scaling-up potential. Companies such as the UAE’s Etisalat and India’s Bharti Airtel are facilitating the much-needed expansion of telecommunications networks. The improvement in internet connectivity that this delivers is spawning a host of digital startups that can access new consumers online. International infrastructure construction companies and operators from China and the GCC have identified opportunities to participate in critical infrastructure development projects in Africa too.

High-interest rates offered by domestic banks are a perennial problem for businesses seeking growth finance. Alternative sources such as venture capital (VC), private equity (PE), development finance institutions and even crowdfunding have been more appealing. PE firms closed deals worth US$25bn across Africa between 2013 and 2018, while VC firms recorded deals worth US$725m in 2018, growing almost fourfold from 2017. PE is particularly relevant, as it tends to focus on more established firms looking to scale up. VC firms, which often finance companies at a nascent stage, tend to pursue higher growth rates. With both, there is a risk of a forced exit. Yet, both represent an important pool of finance for businesses hungry for growth.

Corporations are fuelling African business expansions, through direct stakes and VC funds. Prominent global players include Tencent and Mastercard as well as African corporations such as MTN, proving that blue-chip brands still believe in Africa’s growth story. Offering more examples of successful scale-ups in Africa will encourage more investors to seize on the opportunities of the continent.

Gulf investment is concentrated in East Africa, with the UAE leading the charge. The UAE is among the top ten source countries for foreign direct investment in SSA, investing US$649m between 2015 and early 2019. PE and VC have been limited as some investors find that deals on the continent are overpriced. Gulf investors must work with a longer time horizon in mind, according to the experts interviewed, evidenced by examples from a range of Gulf-based businesses such as DP World in port infrastructure, Etisalat in telecommunications, Acwa Power in energy and Salalah Mills in food processing.

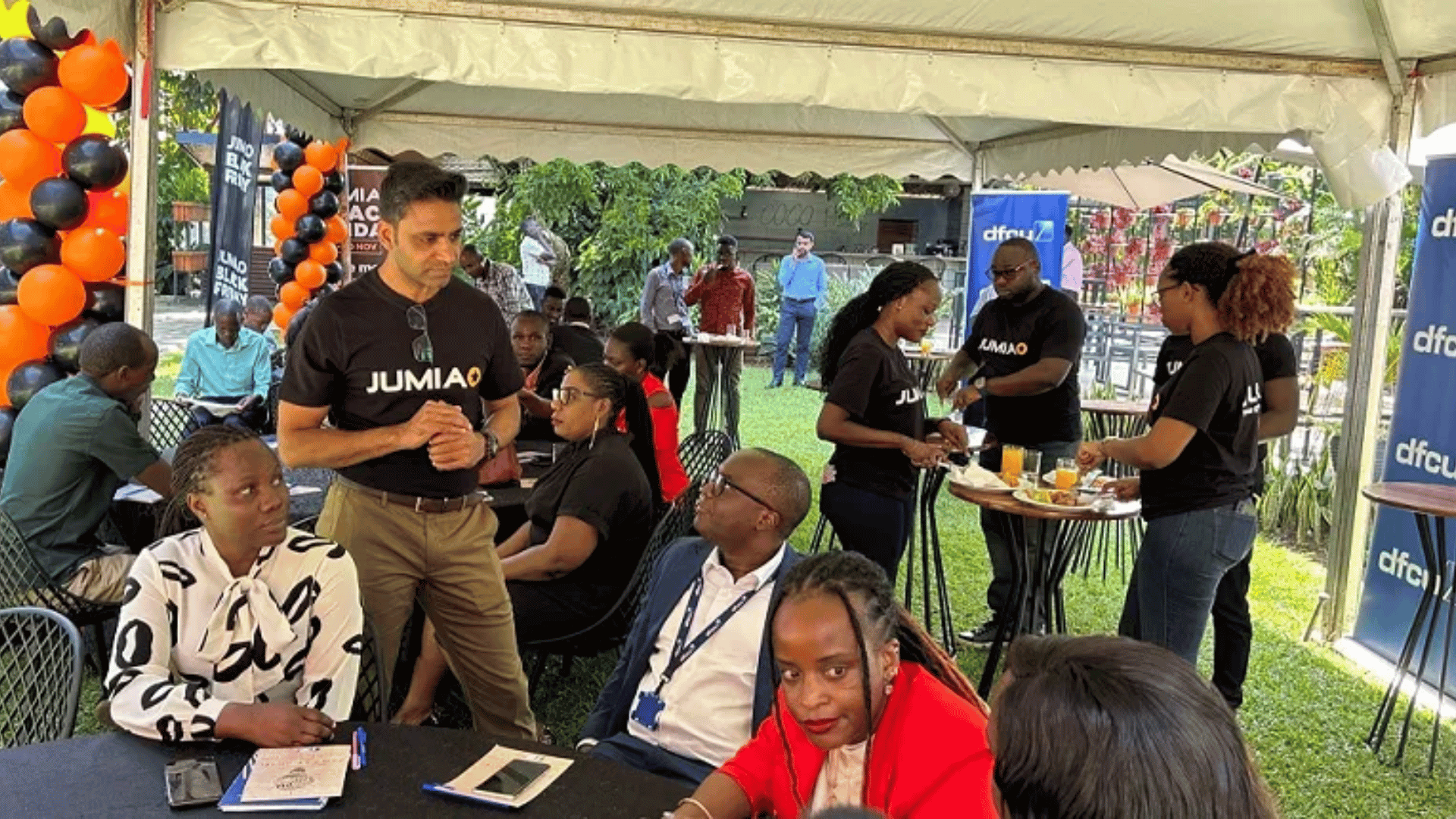

About Jumia

Jumia is a leading e-commerce platform in Africa. Our marketplace is supported by our proprietary logistics business, Jumia Logistics, and our digital payment and fintech platform, JumiaPay. Jumia Logistics enables the seamless delivery of millions of packages while JumiaPay facilitates online payments and the distribution of a broad range of digital and financial services.

Follow us on, Linkedin Jumia Group and X @Jumia_Group

For more information about Jumia:

Abdesslam Benzitouni

[email protected]

More News