News

Jumia Technologies: Axian Telecom's Backing And Improved Guidance Add To The Bullish Case

August 11, 2025Company News

Summary

-

Jumia's Q2 earnings showed strong operational improvement, raised 2025 guidance, and reaffirmed 2026 targets, driving a significant post-earnings stock breakout.

-

Axian Telecom's 8% stake validates Jumia's strategy, enhances credibility, and provides a potential floor for the stock without shifting the core investment thesis.

-

Jumia is outpacing competitors like Temu, expanding international supplier relationships, and growing rapidly in key markets, especially Nigeria and Ghana.

-

Jumia's improving model and path to profitability justify maintaining my strong buy rating for long-term investors.

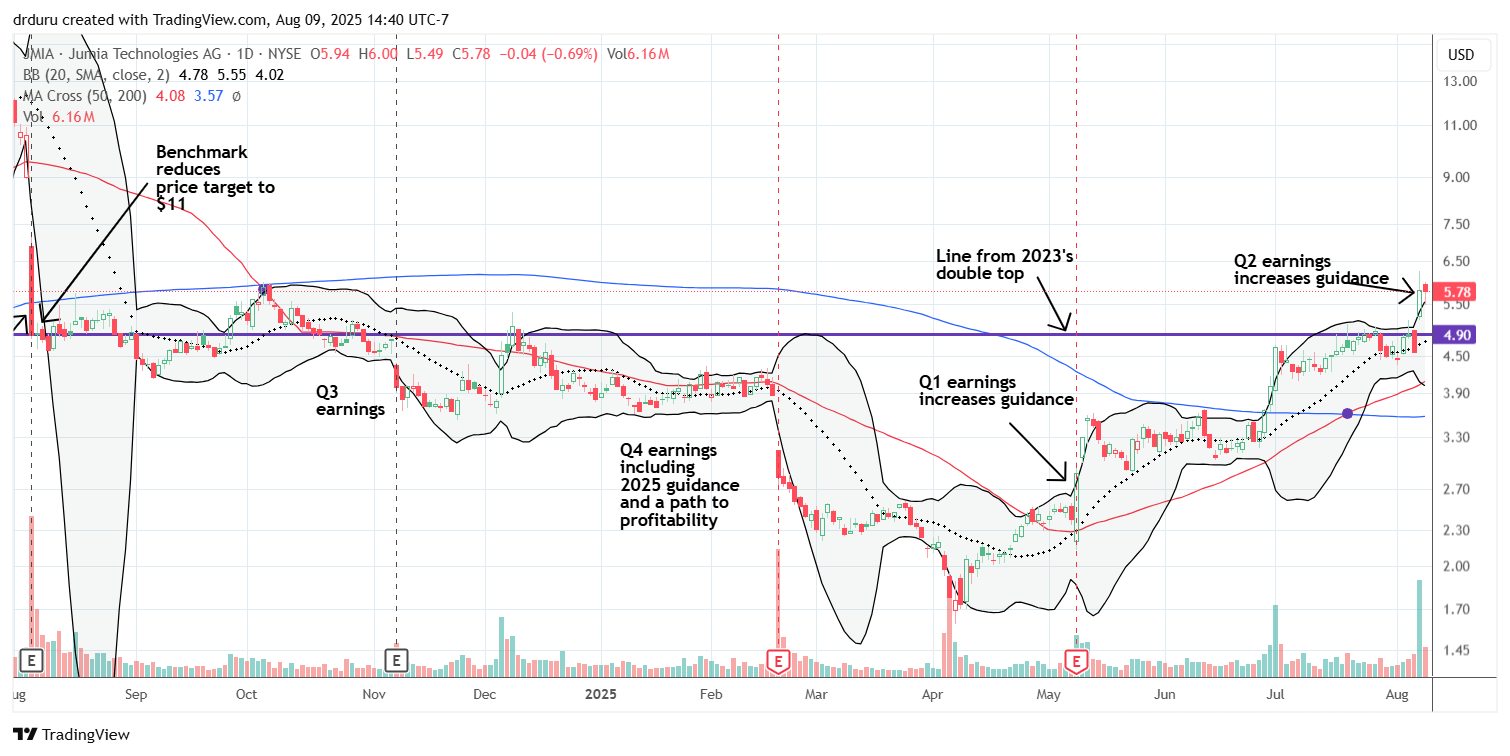

Jumia Technologies (NYSE:JMIA) delivered another breakthrough, a “clean” quarterly earnings report. The Africa e-commerce platform has lapsed currency devaluations and lapsed one-time effects in the Egyptian market, and the company is using the same core financial metrics to measure success. With guidance improved for 2025 and a re-affirmation of 2026 guidance in place, the stock soared 27% post-earnings. At the time of writing, JMIA is still holding an important breakout above its double-top, dating all the way back to 2023 (see the chart below). With the company performing much better than it was 2+ years ago and with future prospects looking better than ever, JMIA continues to offer substantial upside potential for long-term, resilient investors who can navigate the high volatility that comes with this kind of bet on a maturing market.

JMIA convincingly broke out above a key (and persisting) resistance level (TradingView)

JMIA convincingly broke out above a key (and persisting) resistance level (TradingView)As usual, I sat down with CEO Francis Dufay to discuss the company’s latest performance. We mainly covered the usual round of questions about results. I started with the recent news and buzz surrounding the interest Axian Telecom has taken in Jumia.

Axian Telecom Bets Big on Jumia

Axian Telecom is based in Mauritius and is Africa’s 6th largest mobile operator. The company has telecom operations spanning numerous countries with over 40M customers. On May 30th, Axian announced the acquisition of an 8% stake in JMIA saying that “AXIAN Telecom’s management is supportive of JUMIA’s strategic vision, and we look forward to contributing positively to its growth and success where we can.” The stake is a major commitment in words and action that is already paying off given the roughly 79% run-up since this news. Dufay said that Axian gives Jumia very strong validation: “it is very important that such a company with such a successful management team that understands Africa and African consumers so well believes in e-commerce in Africa…and they believe in our plan and our management.” Dufay expects to build value through synergies and cost efficiencies. However, Dufay was careful to note that Jumia’s strategic focus will not change as it drives toward breakeven in 2027.

Following the stake, there were rumors that Axian was also considering a complete acquisition. I did not discuss these rumors with Dufay. These kinds of rumors are not surprising after a large company decides to acquire a large stake. As readers know, I have been a long-term investor in Jumia for the potential of e-commerce in Africa. An eventual acquisition would be a bonus, but I do not see such prospects as forming a core investment thesis for JMIA. I think of Axian’s backing as a kind of floor for the company instead of a reason to speculate on acquisition-related upside.

Guidance

Jumia raised guidance for 2025 and kept 2026 the same. Dufay explained that “we’re confident…have much better visibility…but we don’t want to rush to change 2026 at this stage.” The company provided detailed 2025 and 2026 guidance in the earnings presentation:

-

Physical goods orders growth of 25% to 30% year-over-year, up from 20% to 25%.

-

GMV (gross merchandise value) growth of 15% to 20% year-over-year, up from 10% to 15%.

-

Loss before income tax from -$45M to -$50M, improved from -$50M to -$55M.

-

Cash burn will drop further in 2026 with a loss before income tax from -$25M to -$30M for the year, resulting in breakeven for Q4 2026 and full profitability in 2027.

Given the potentially volatile macro environment, I do not expect a smooth and linear path to full profitability. However, dips in the stock related to such volatility should offer fresh buying opportunities for investors (and traders).

Costs

Fulfillment cost was the main blemish on the Q2 earnings report. Fulfillment expense for physical goods orders increased 1% per unit, down 5% on a constant currency basis. Dufay acknowledged the drawback but noted that fulfillment costs are mainly incurred in the local currency, and this time around Jumia actually experienced the “positive headwind” of stronger local currencies as a main driver. Strong local currencies can be a positive for revenues but a potential negative for costs. More importantly, Jumia has a range of initiatives that give the company a stronger base of efficiencies: warehouse consolidation, call center optimization, including the deployment of AI that will start answering more complex support requests, and warehouse staff productivity. Second-half seasonality will also enable more scale efficiencies for the company.

I expected the cost of sales and advertising (including marketing) to go up given Dufay’s announcement last quarter that Jumia would start to expand marketing given its prior work on optimizing its marketing operations. Instead, sales and advertising declined 6% (7% in constant currency) year-over-year (this line item increases quarter-over-quarter because of the Jumia anniversary campaign). Dufay explained that Jumia has “added money to some channels” as part of some experiments. Jumia has expanded advertising in offline, radio, and TV campaigns in Nigeria in an effort to build the top of the funnel and build the nationwide brand. Jumia also plans to expand with paid channels on TikTok, Meta, and Google.

Dufay also noted that “better assortment, better coverage of the country, more reliable delivery, better logistics, and higher satisfaction” allows Jumia to craft a more compelling market message about its value proposition at this juncture. The timing is right, especially with the company’s uptrending NPS (net promotor score). In Q2, Jumia’s NPS increased from 59.5 in Q2 2024 to 62.9. In Q1, the NPS soared year-over-year from 53.0 to 61.9.

Competition

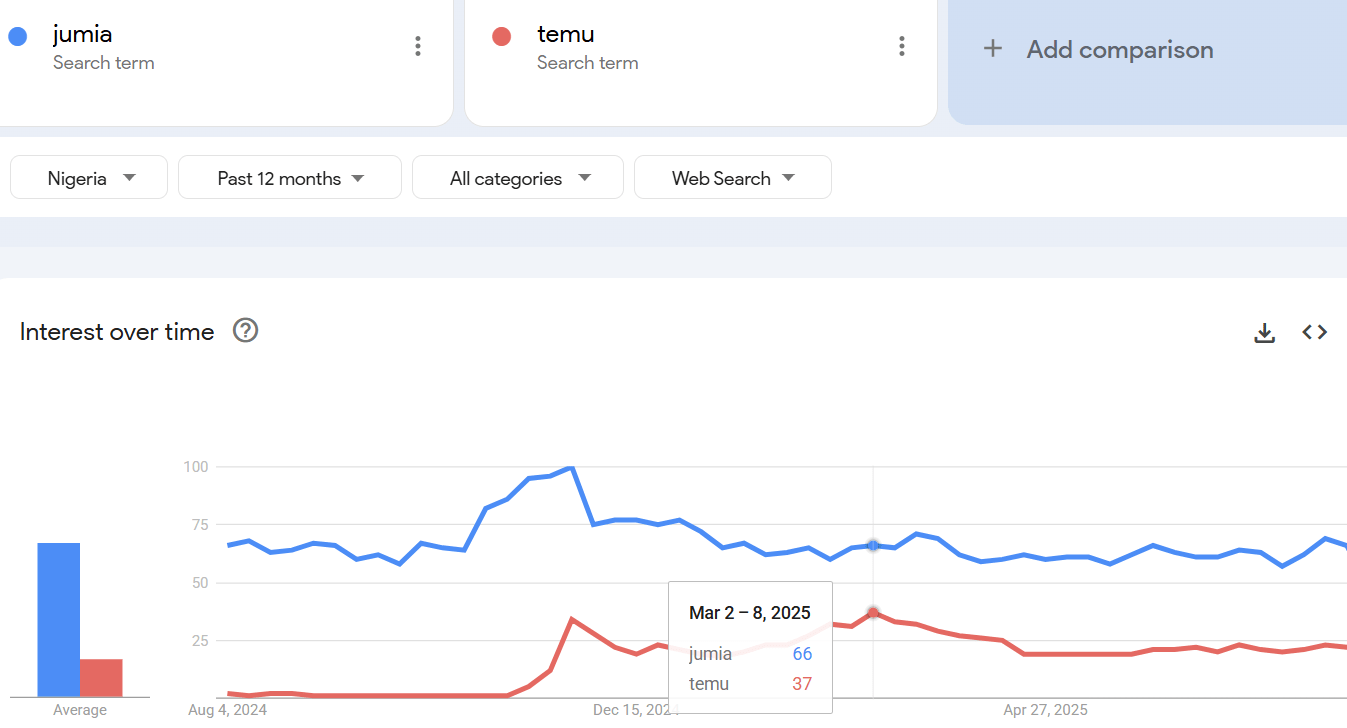

During the last earnings conference call, Dufay addressed competition head-on and made the strong case that Jumia is well-positioned, especially with governments beyond the U.S. wising up to closing the de minimis loophole for duty-free imported goods that formed the core of the business model for purveyors of cheap, low quality Chinese goods. This time around, Dufay took me through a timeline on Google trends for Nigeria for the last 12 months as an example to explain how Jumia has fared against Temu.

According to Nigeria's Google trends, Jumia is distancing itself from Temu (Google Trends)

According to Nigeria's Google trends, Jumia is distancing itself from Temu (Google Trends)Dufay defiantly recalled how he was asked, “When is Jumia going to die?” after Temu entered the market. The Google trends chart shows the dramatic increase in search activity for Temu upon its entry around Black Friday of last year, November. Temu spent millions on online channels but had no “boots on the ground.” They became the number one app downloaded after paying for a lot of app advertising. Interest started fading from that initial surge, so Temu “pushed the throttle” again in March with free nationwide delivery. Consumers even received $100 vouchers to spend on the platform. Soon after this largess, Temu was forced to end most of its marketing and raise prices. With no customer support and selling low-quality goods, mixed in with Nigerians' natural fear of online scams, Temu’s popularity has understandably waned. The Google search activity sharply diverged between Jumia and Temu from the March peak. Ironically, Temu could have learned from Jumia’s earlier experience that you cannot build a sustainable e-commerce business (in Nigeria) on expensive marketing. Even more ironic is that Temu’s efforts may have expanded the total addressable market for Jumia.

Meanwhile, Jumia continues to expand its relationships with international suppliers, especially in China. Gross items sold from international suppliers increased 36% year-over-year from 2.2M to 2.6M gross items. Dufay noted that this expansion shows the relevance of this part of the business, and Jumia’s international operational acumen.

Country-Level Performance

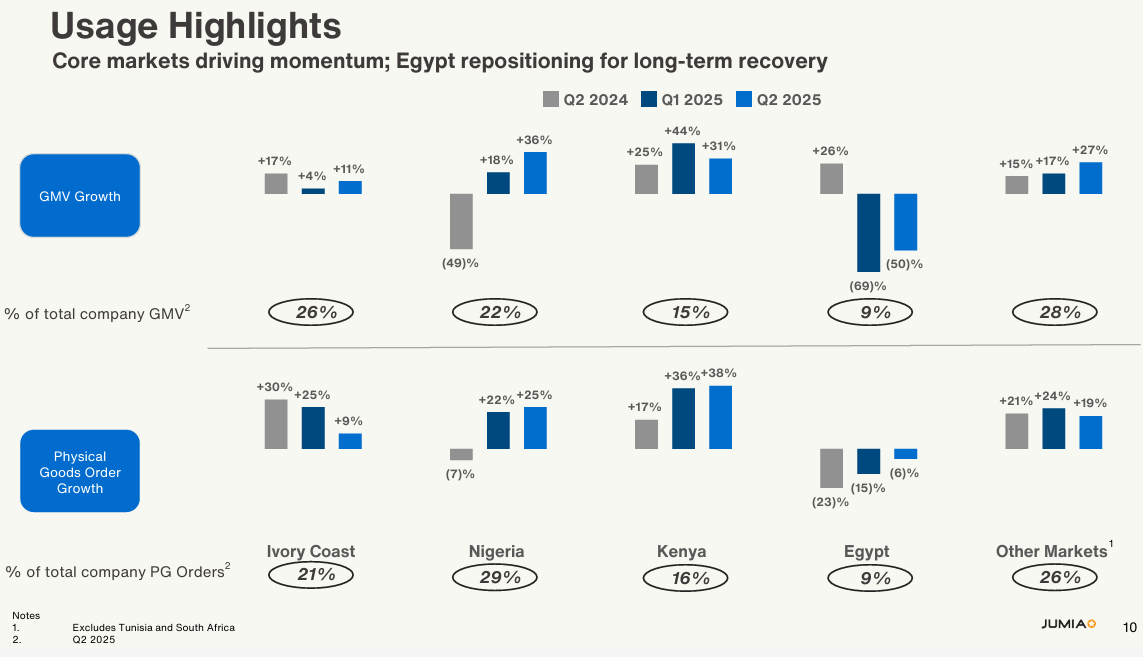

Jumia now breaks out its usage performance by country.

Jumia usage performance by country (Jumia Q2 2025 Earnings Presentation)

Jumia usage performance by country (Jumia Q2 2025 Earnings Presentation)Nigeria was a standout performer with jumps in year-over-year performance for both GMV and physical goods order growth. The recovery for Egypt is underway. However, the decline in growth in Ivory Coast is the other blemish on this quarter’s report. Dufay admitted that he is not happy with 9% or 11% growth in the country. While Ivory Coast is now a mature market for Jumia, Dufay expects that once the country gets through its Presidential election period and Jumia restarts marketing campaigns, Ivory Coast will return to strong double digits growth.

Ghana was the stellar performer in “other markets” with 100% year-over-year growth in physical orders. Dufay explained that the Ghanaian market is catching up from being under penetrated thanks to upcountry expansion, increased assortment from Chinese and local suppliers, and “clean” logistics.

The overall process of upcountry expansion continues to go well for Jumia. The share of gross orders from outside the main urban centers jumped from 52.2% a year ago to 59.0% in Q2. Dufay expects this share to continue to expand over time and bring additional economic benefits.

Overall GMV growth was 9% in absolute and constant currency terms, excluding the exited markets of South Africa and Tunisia. Revenue was up 25%, 22% in constant currency. Jumia increased its 90-day retention repurchase rate from 37.0% a year ago to 41.7% in Q1 (there is a one quarter lag in reporting this number). In Q4, this rate was 44.6%, up from 39.5%.

Logistics

The share of packages transiting through a PUS (pick-up station) is now at 70%, a 13 percentage point leap from a year ago. Dufay expects this number to go even higher because the PUS is “cheaper and there’s this physical interaction. It’s more reassuring” to the consumer. In some cities the share of PUS for shipped goods is already above 75%. The PUS is cheaper for customers, so they have more purchasing power. Moreover, the PUS provides a great branding vehicle for Jumia.

The PUS provides a competitive advantage for Jumia given the lower cost form of logistics as well as a method for offering logistics as a service.

Conclusion

Regular readers are undoubtedly not surprised I maintained my strong buy rating after this Q2 earnings report. The stock trades at a price that is much lower than its level during times when the business was not as robust as it is now. The current breakout is only above a double-top in price from back in 2023. JMIA is barely 2/3 of last year’s high when, for a glimmer, the market suddenly acknowledged the possibilities for JMIA and the company.

I recognize that the company incurs a significant risk premium discount given it is operating in a market that is still maturing in a macroeconomic environment that can be volatile. However, the company’s operating model continues to improve by the quarter. Having Axian on board is a major point of validation and provides a likely floor for the company and its stock. Once the market accepts and acknowledges that Jumia is on track to get to breakeven and then full profitability, the stock could accelerate to the upside. Still, as a reminder, I do not expect a smooth, linear path from here to there.

Be careful out there!

Read the original article on Seeking Alpha

About Jumia

Jumia is a leading e-commerce platform in Africa. Our marketplace is supported by our proprietary logistics business, Jumia Logistics, and our digital payment and fintech platform, JumiaPay. Jumia Logistics enables the seamless delivery of millions of packages while JumiaPay facilitates online payments and the distribution of a broad range of digital and financial services.

Follow us on, Linkedin Jumia Group and X @Jumia_Group

For more information about Jumia:

Abdesslam Benzitouni

[email protected]

More News